r&d tax credit calculation example

73150 pre-claim Corporation Tax 48450 post-relief Corporation Tax 24700 saving or refund Calculating RD tax credit for loss-making SMEs. For profit-making businesses RD tax credits reduce your Corporation Tax bill.

How To Be Proactive With R D Tax Credits Accountants Guide

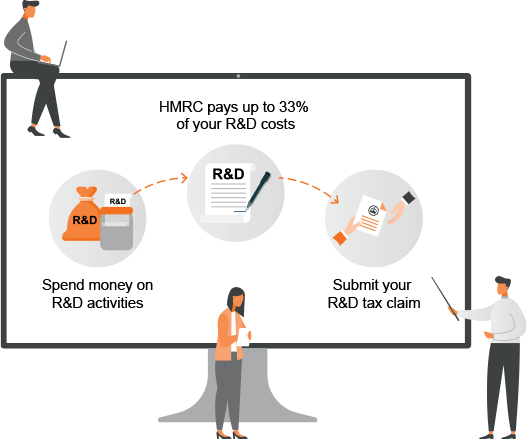

For example if you spent 200000 on RD last year you could receive a 22000 cash credit or tax reduction.

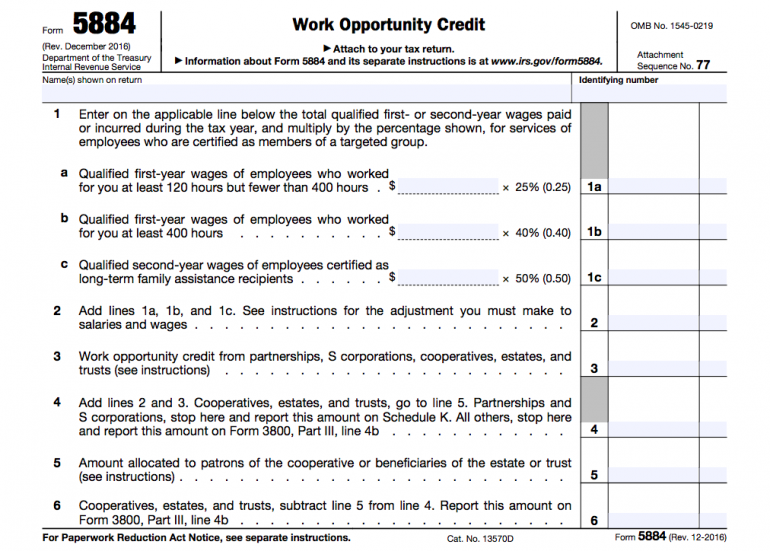

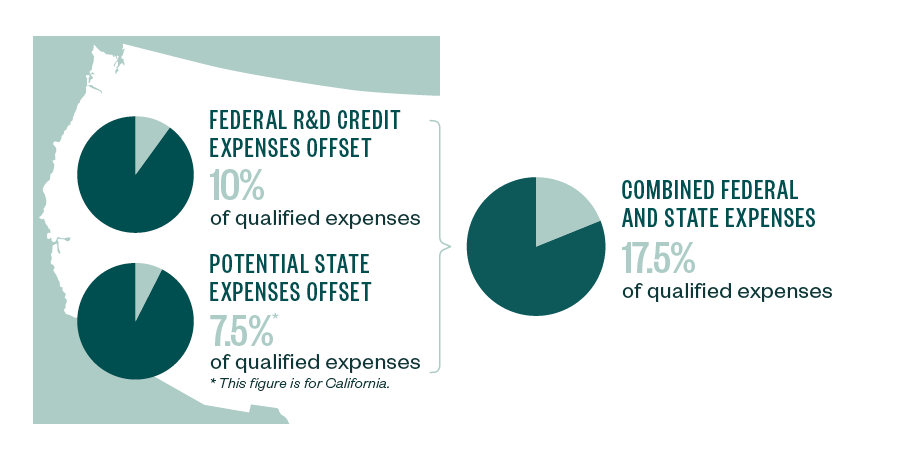

. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. The Kruze Consulting RD Tax Credit Calculator is designed to estimate your RD tax credit using Federal Form 6765. There are two methods of computation of R D tax credits -Traditional Method and Alternative Simplified Credit Method.

You can see full RD tax credit calculation examples in the how to calculate RD tax credit section of our ultimate guide. Calculating RD Tax Credits for a Large. When you qualify as an SME in terms of the SME scheme but youre making a loss instead of a profit the RD Tax Credit Calculation is the same as the procedure set out.

RD Tax Credit Calculator Our RD tax credit calculator will help you estimate. Do you currently claim the credit. Calculating RD relief for an SME depends on whether your business is profit- or loss-making.

To try to develop or improve the. If you would like to discuss any. The RRC is an incremental credit that equals 20 of a taxpayers current-year QREs that exceed a base amount which is determined by applying the taxpayers historical percentage of gross.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be 33350. Do you pay engineers natural scientists or software developers in the US. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly.

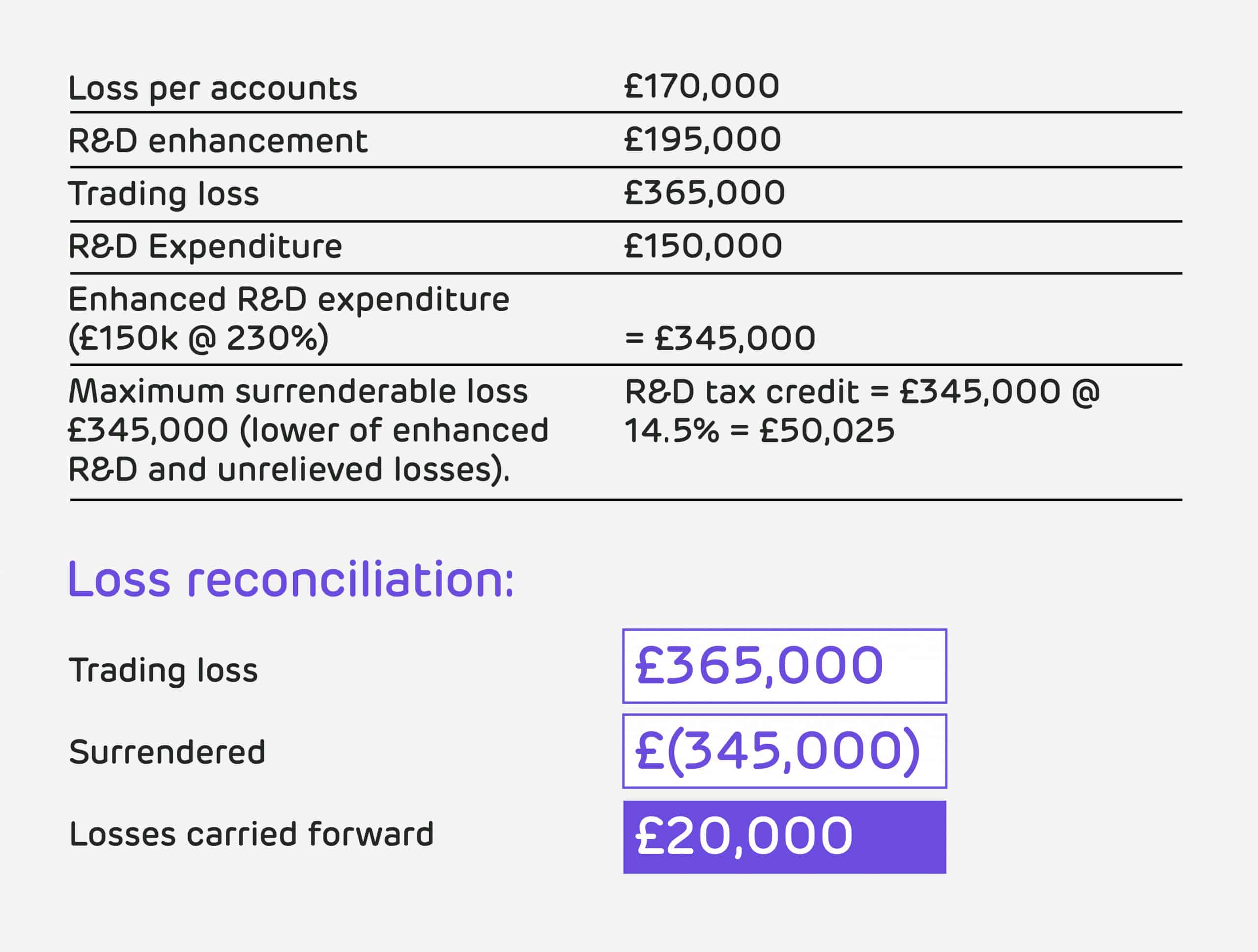

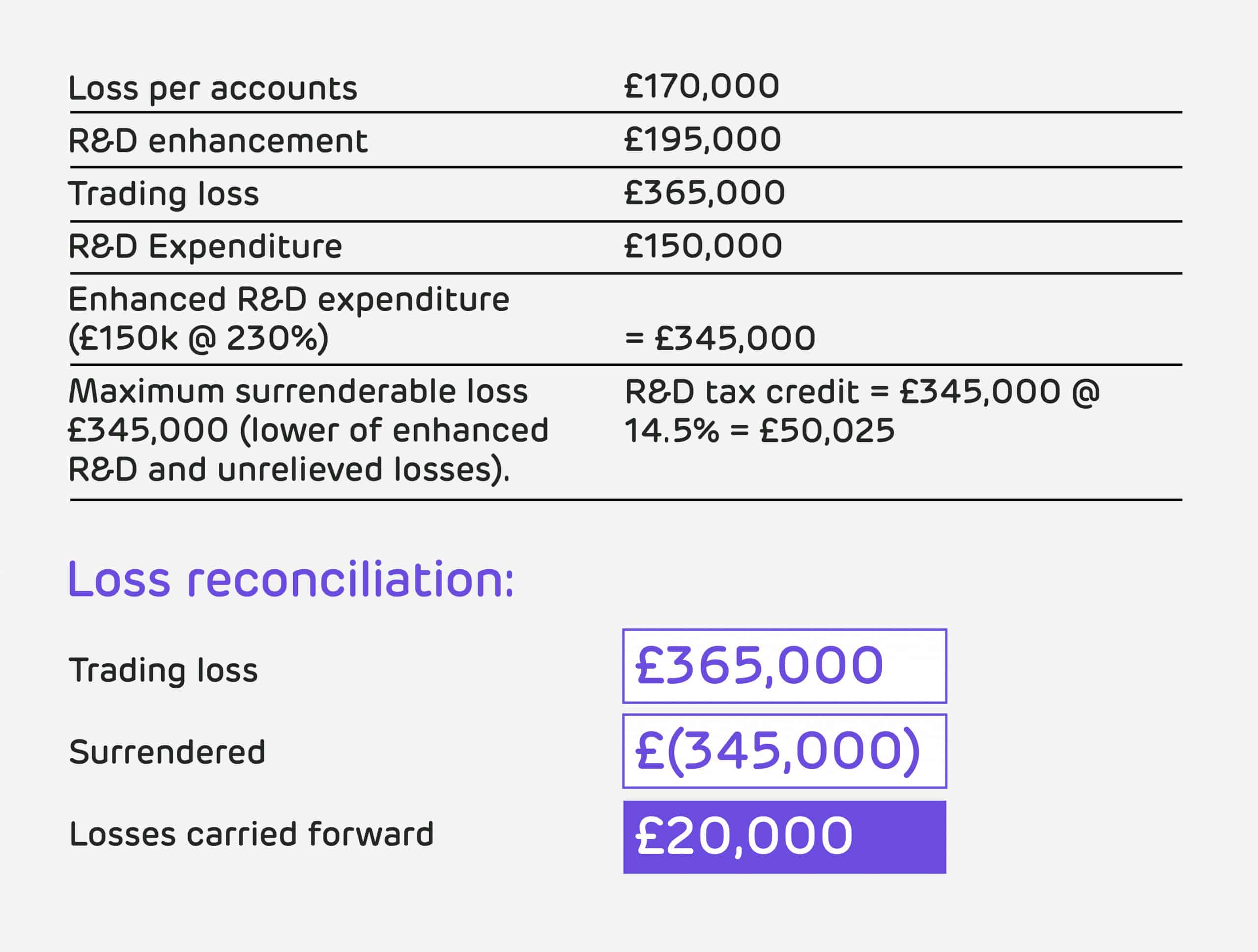

Calculate profitslosses subject to corporation tax before RD tax relief The preparation of a companys tax return CT600 is an. Heres a quick summary for a hypothetical loss-making SME. This calculation example shows how RD tax credits can benefit a company via a tax saving of 9500 and payable tax credit of 39875.

70000 - 24167 45833 x 14. RD TAX CREDIT CALCULATOR 1. Its a tax credit that can reduce.

About the RD Tax Credit. SME RD tax credit calculations - Detailed Example Step 1. Assuming your business fits these criteria you can check below for example calculations for RD tax credits.

A Profitable SME RD Tax Credit Calculation Lets assume the following. RD tax credits calculator Get in touch Were here to help Get a quick estimate of your potential claim value Drag the slider or enter your estimated spend value below to view. The rate of relief is.

Loss Making SME Calculation Large Companies RDEC Profitable and loss making. Let Kruze Consulting handle your startups RD Tax Credit analysis and. Rufus Meakin is a specialist in helping companies prepare large and complex RD Tax Credit claims where robust HMRC compliance is essential.

The research and development tax credit is an incentive for US companies to increase their spending on RD in the country. Traditional method Under the traditional method you.

U S Research And Development Tax Credit The Cpa Journal

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

R D Tax Credit Federal Research And Development Tax Treatment

R D Tax Credit How Your Work Qualifies Alliantgroup

R D Tax Credit Calculation Complete In A Few Simple Steps

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Insight 2017 Tax Law Changes Increases Value Of R D Tax Credit

The R D Tax Credit Aspects Of Saas Start Ups R D Tax Savers

Small Business Tax Credits The Complete Guide Nerdwallet

R D Tax Credit Calculation Using The Proper Method To Calculate R D Wages

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

A Simple Guide To The R D Tax Credit Bench Accounting

Tips For Software Companies To Claim R D Tax Credits

Rdec Scheme R D Expenditure Credit Explained

Time Is Of The Essence For R D Tax Credits Fora Financial Blog

R D Tax Credits Irs Form 6765 Instructions Adp

R D Tax Credits Explained Are You Eligible What Projects Qualify